The new tax laws being proposed by the National government are not going to prevent foreign property speculation they are a feeble attempt designed to appease the public that the government has taken action. These New Tax laws are not a deterrent just a few minor roadblocks to foreign venture capitalists.

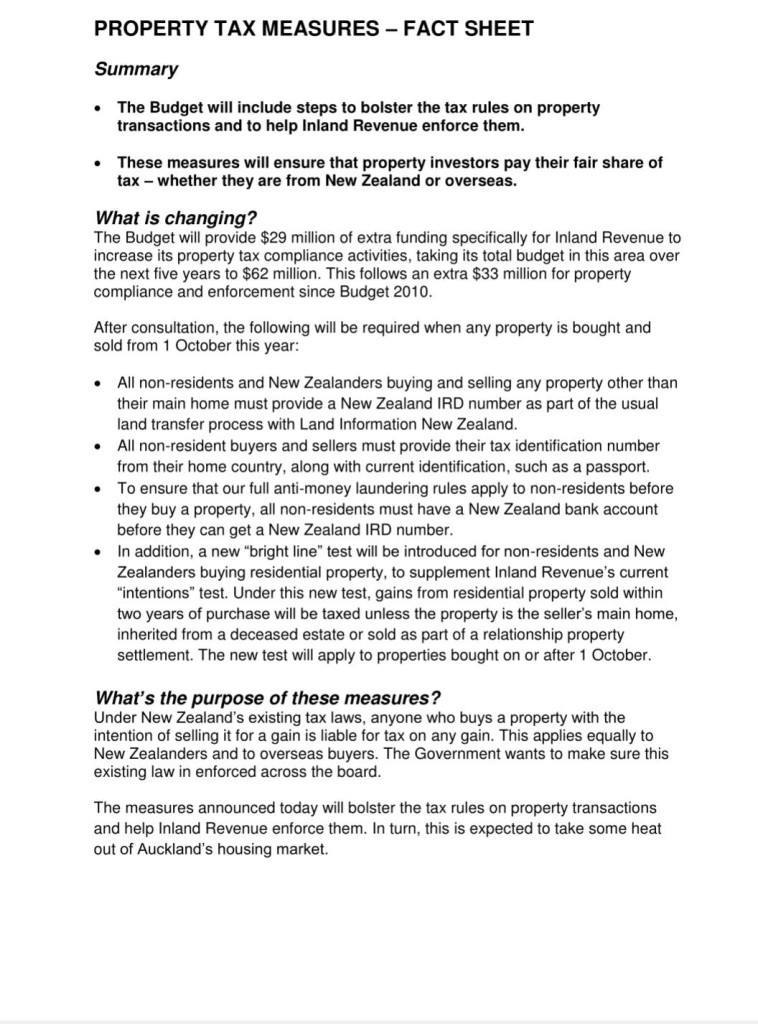

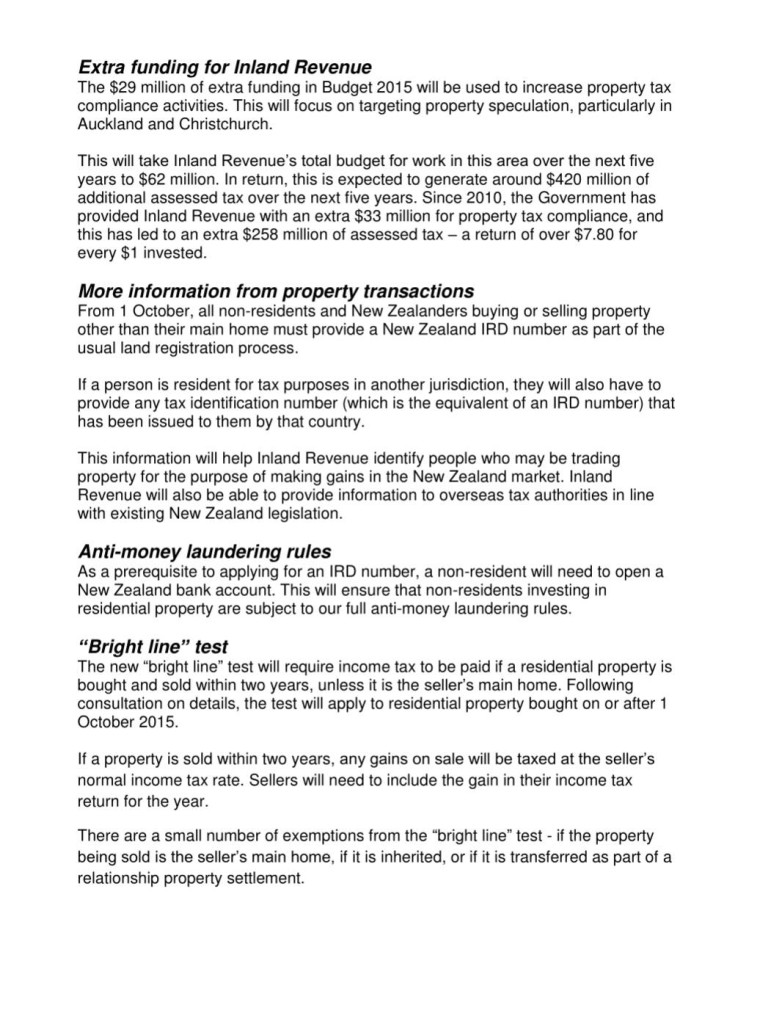

All non-residents must provide an IRD number means nothing, because you do not have to be a New Zealand citizen or resident to have an IRD number. The entire human population of Earth can apply for a New Zealand IRD number.

All-non residents must have a New Zealand bank account -so they can put $5 in the account while buying $5 million worth of real estate on foreign capital.

All non-resident property buyers must provide identification -This weak expectation seems voluntary from Inland revenue how does Inland revenue identify New Zealand residents from non-resident if presenting identification is not compulsory for all buyers.

The bright line test is the bare minimum period of two years. It’s essential for property speculators to spend a minimum period of two years in the market to get maximum profits, while continuing to destablise the New Zealand economy.

These tax measures are not a deterrent they are minor roadblocks for non-resident property speculators nothing in the fact sheets is designed to segregate non resident property speculators from Kiwi families trying to buy the family home.