I’m a computer gamer and I buy my PC games online as a digital download . If I need a product I import it from China using New Zealand posts youshop service that delivers my product to a warehouse in Shanghai and then transferred to New Zealand and delivered. I don’t pay GST and never have I’m not doing this to avoid paying taxes its just plain cheaper.

In the 1980’s when Sir Roger Douglas invented GST (Goods and Service Tax) the Internet had not been invented, he never guessed within 30 years that New Zealanders would buy the majority of their products and services from overseas. Recently the National government raised GST from 12.5% to 15% to increase revenue. This has little affect on tax revenue as more New Zealanders pay foreign excise taxes purchasing goods from overseas and this certainly helps foreign economies but does nothing for the New Zealand economy.

In my view GST is a cruel tax as unemployment is at around 6% many New Zealanders have to accept there are not enough jobs to go around. We can blame the unemployed and accuse them of being lazy or say they aren’t trying hard enough but the reality is there genuinely is not enough Jobs. The people most disaffected by this unemployment is Maori and Pasifika New Zealanders, they are at the bottom of the food chain and struggle to make ends meet.

For example a 21 year old single woman receives the unemployment benefit, before tax she gets $192 her net earning after tax is $171.84 then she needs to buy food, rent and electricity and pay GST on all of these. That reduces her buying capacity to $146.06, after $100 on rent and electricity bill of $30 including GST that leaves approx $16 dollars to buy food and find a Job. GST is affecting superannuates, minimum wage workers and even the middle income workers that lose 15% of everything they earn.

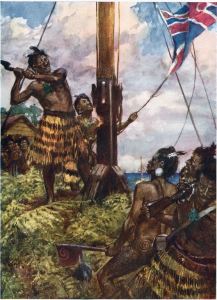

Mana has a policy of abolishing GST because struggling working class New Zealanders can’t afford this drain and have developed a new financial transaction tax FTT called the “Hone Heke Tax”. The Hone Heke tax is identical to the robin hood tax in the European union that has been highly successful. Of course we can’t call it a Robin Hood Tax because he lived in Sherwood Forest in the United Kingdom. The nearest equivalent in New Zealand is Hone Heke who chopped down the union jack in protest of British customs tariff.

has a policy of abolishing GST because struggling working class New Zealanders can’t afford this drain and have developed a new financial transaction tax FTT called the “Hone Heke Tax”. The Hone Heke tax is identical to the robin hood tax in the European union that has been highly successful. Of course we can’t call it a Robin Hood Tax because he lived in Sherwood Forest in the United Kingdom. The nearest equivalent in New Zealand is Hone Heke who chopped down the union jack in protest of British customs tariff.

The Hone Heke tax gains revenue from the purchase and sale of stocks, bonds, commodities, unit trusts, mutual funds, and derivatives such as futures and options at only 0.1%. This tax revenue is much greater than GST could ever gain in revenue. Billions of dollars moves around financial markets in the buying and selling of companies and Inland Revenue doesn’t get a cent. It doesn’t make sense why we tax the poor working class New Zealander and are protecting money in the cloud.

Now here is why the National government will never implement a financial transaction tax even though the United Kingdom where our head of state lives is seriously considering it. The majority of the National party donors receive extraordinary wealth from stocks, bonds, commodities, unit trusts, mutual funds, and derivatives such as futures and options. They simply refuse being taxed at 0.1% this might jeopardize their summer holiday in Denerau Island.

Secondly they will tell you its too complicated for Inland revenue to implement a financial transaction tax. If you were to ask small business like Taxi drivers they would say GST is extraordinarily complex it puts a burden on them to hire an accountant and lose even more hard earned money. Many have to resort to tax evasion and not declare a few taxi rides to make enough money for the week. Every year small business struggle to submit GST Tax returns and many business declare bankruptcy.

Thirdly the Prime minister made his first million dollars on the stock exchange leveraging against the over valued New Zealand dollar in 1984 in the first week of the 4th labour government , the tax payer had to pick up the bill on that.

Its high time that New Zealanders stop accepting the status quo there is a better way, we don’t need to lose 15% of our wages because its too hard for an army of government officials to design financial transaction tax. We don’t need to help stock market traders live a life of wolf of wall street, Unemployed beneficiaries should afford to eat, the cost of living has sky rocketed under this National government we need change. Lets put the burden of Tax on those who can afford it.